At this year’s Cairo Water Week (CWW), the conversation around resilient nature-based water solutions (RNBWS) took on new urgency. As water scarcity, land degradation and climate stress deepen across the Middle East and North Africa (MENA), leaders and practitioners are turning to RNBWS to restore water security, sustain livelihoods and maintain ecosystems.

Resilient nature-based water solutions are critical for navigating both ecosystem and societal resilience. In the face of water scarcity and increasingly vulnerable livelihoods, and in a context where budgets are tightening and priorities are shifting, such water solutions offer a lower-cost, high-return approach that delivers co-benefits across sectors.

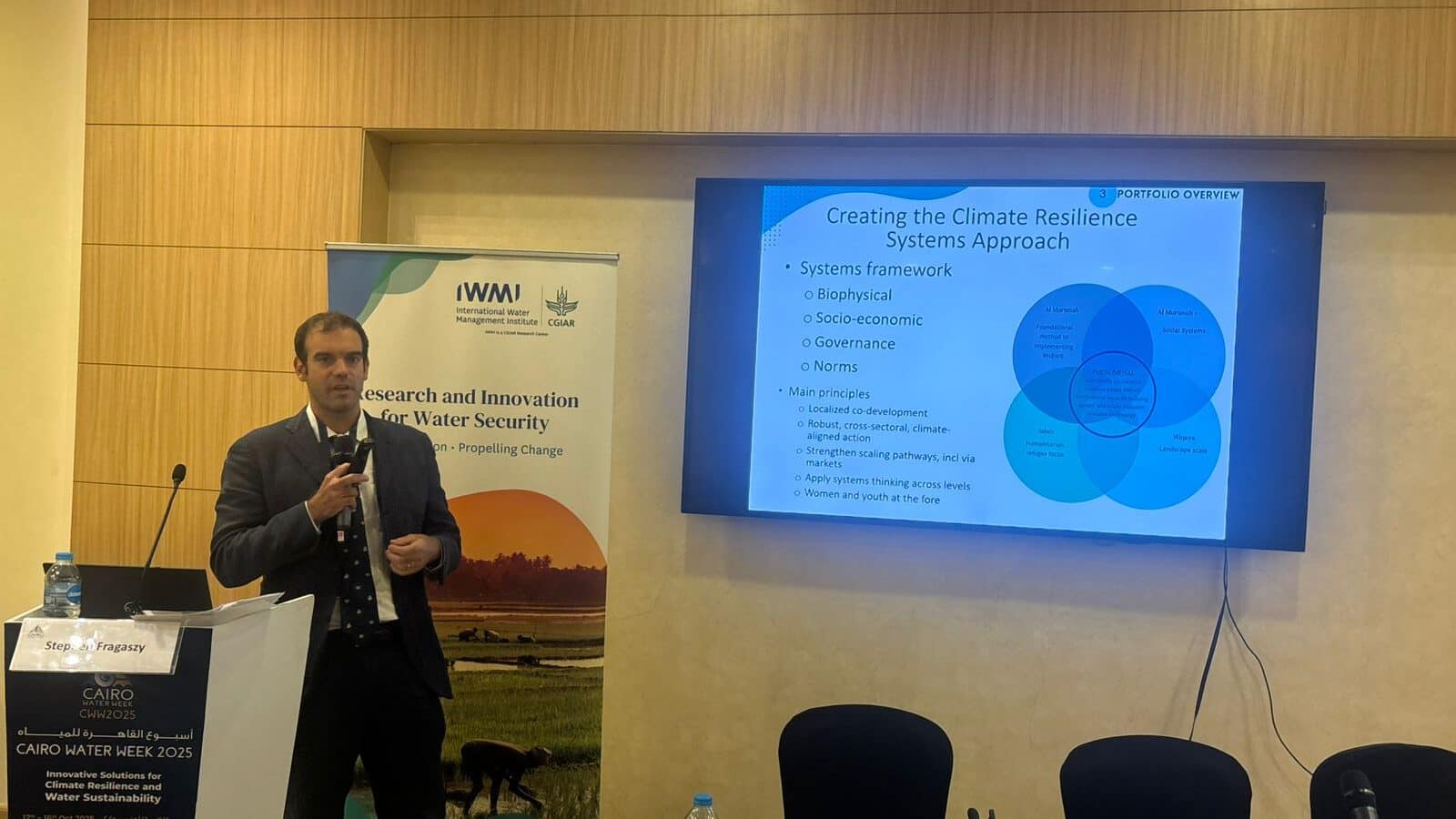

IWMI’s Al Murunah project aims to increase water security in the MENA region through the integration of nature-based solutions (NbS) and agricultural water management in the face of climate change and land degradation. During CWW, IWMI led discussions on scaling RNBWS through synergies with regional policies and financing systems, including in post-conflict and refugee-hosting contexts. For projects like Al Murunah, this is not achieved solely through technical work; rather, it is a systemic approach with community-driven agendas that build ownership from the ground up and link practice to policy and financial frameworks.

“Our pilot interventions are planned by local governments, water associations, and women’s, smallholder and youth groups to address the stressors disrupting natural resources management, ecosystem functions and livelihoods,” said Stephen Fragaszy, researcher and Al Murunah’s project lead. “We work collaboratively to integrate interventions into governance, markets and social systems to address these challenges. These pilots have helped us test and de-risk approaches before scaling.”

Finance and governance as two pillars to scale local action

Throughout the discussions on scaling nature-based water solutions at Cairo Water Week, two words kept surfacing: governance and finance.

Stronger governance is essential if nature-based solutions are to move beyond the pilot stage and reach scale. Mona Bedeir, Senior Sustainability Officer at the Commercial Investment Bank (CIB) in Egypt, reflected on the need to make NbS a policy norm. “Governance is the gateway to scaling. Once nature-based solutions are embedded in national climate and development strategies, they move from being pilot projects to policy norms. This creates sustained demand, and that’s what makes financing flow more naturally.”

Adding to this, Ali Hayajneh, program manager for water and climate change at the International Union for Conservation of Nature (IUCN) in West Asia, observed that while many governments already fund NbS projects, “they aren’t formally recognized in policy, which is a missed opportunity for institutionalization,” and therefore, investment.

Clear standards, credible monitoring systems and robust policy frameworks are prerequisites for banks to confidently channel financing towards nature-based solutions. “Banks need clarity and consistency and that’s where standards, monitoring systems and national strategies come in. With better policy alignment, nature-based solutions can move from being a sustainability concept to a viable investment class,” explained Bedeir.

Blended finance, which brings together public and private investment, is proving to be a promising way to fund nature-based solutions that might otherwise be seen as too risky by traditional investors.

“De-risking through blended finance is key as it generates the evidence and confidence that cooperatives, companies and financiers need to invest at scale,” said Sam Grout-Smith, the deputy director for the Regional and North Africa Department at the UK’s Foreign, Commonwealth and Development Office (FCDO). UK International Development and its partners are supporting policy and institutional strengthening so governments can plan, assess and report on nature-based solutions to better attract this financing.

Development actors, investors and host communities must co-create in today’s landscape of tighter budgets and competing priorities. That means sharing expertise, listening locally and investing in the capacity of government agencies to take early risks. Investment in human and social capital tied to NbS remains the most enduring form of climate finance.

Meanwhile, the Islamic Development Bank (ISDB) is offering an innovative way to fund nature-based solutions. They have evolved their asset-based financing and economic infrastructure teams to focus on climate adaptation and investments, reframing nature as both a service provider and a tool for managing risk.

Khalid Abdelrahman Ahmad, operations team leader of economic infrastructure at the ISDB’s Regional Hub of Cairo, noted that this approach is already showing results. “Across our 57 member countries, we are piloting nature-based solutions in water and agriculture infrastructure with clear performance indicators. From Oman’s flood protection dams to Kazakhstan’s small dam programs, we are in a better position to prove that nature-based solutions can deliver both economic and environmental returns, as well as a suite of other co-benefits.”

A collaborative path ahead

It is encouraging to see investment partners increasingly viewing nature as part of the business case. IWMI’s work in Al Murunah also focuses on guiding investors to understand how to engage with structures, risks and opportunities for resilient nature-based water solutions.

As the project advances, the team is translating these insights into practical guidance, national scaling plans in Egypt, Jordan, Lebanon and Palestine, and inputs to policy frameworks and reporting tools that can strengthen ongoing financing. These efforts will help position RNBWS within mainstream financial planning and pave the way for broader blended finance models.

Nature-based solutions are a lifeline, but only when tied to policy, governance and infrastructure. Scaling will require partnerships across governments, banks, donors and research institutions, as well as intentional government policies.

The MENA region has immense potential. Resilient nature-based water solutions can move from isolated pilots to a mainstream part of the region’s development future — if we align governance, financing and community leadership.